BTC Price Prediction: $250K Target in Play Amid Institutional Frenzy and Technical Breakout Signals

#BTC

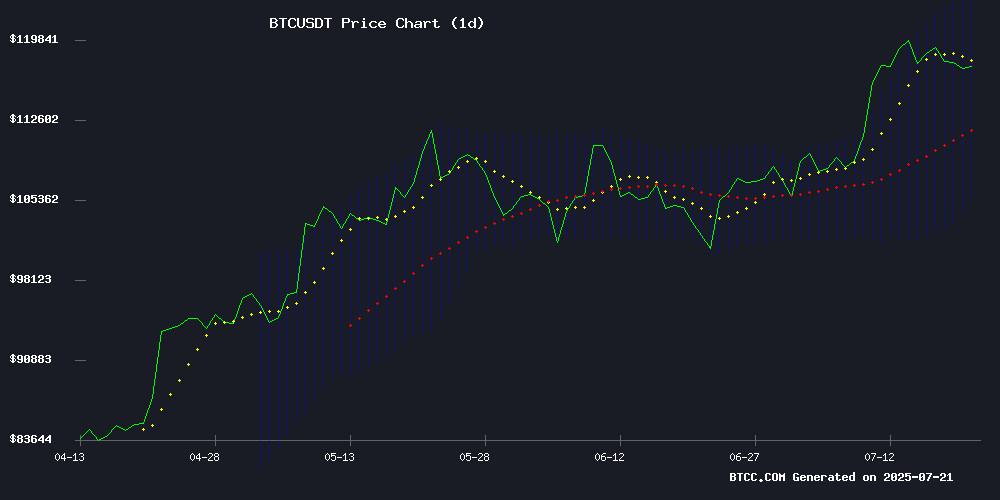

- Technical breakout: Price sustains above 20MA with MACD momentum flip

- Institutional tsunami: ETFs and corporate treasuries absorbing supply

- Event volatility: Fed decision and political catalysts may amplify moves

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

BTC is currently trading at, firmly above its 20-day moving average (114,409 USDT), suggesting near-term bullish momentum. The MACD histogram (-919.67) shows weakening downward pressure, while price hovering NEAR theindicates potential upside volatility. 'The consolidation above the MA support with improving MACD momentum often precedes breakout attempts,' notes BTCC analyst Ava.

Market Sentiment: Institutional Demand and Macro Uncertainty Drive BTC Narrative

Record ETF inflows ($10.5B in 6 weeks) and corporate treasury holdings (now 4% of supply) underscore growing institutional adoption, though Fed policy decisions loom as a volatility catalyst. 'Trump's endorsement and Tom Lee's $250K forecast amplify retail FOMO, but the Fed investigation creates asymmetric risk,' warns Ava. The SQNS selloff after its BTC bet highlights market sensitivity to corporate crypto exposure.

Factors Influencing BTC’s Price

Bitcoin ETFs Continue Record Inflows with $10.5B Over Six Weeks

U.S. spot Bitcoin ETFs have sustained remarkable momentum, attracting $2.39 billion in net inflows last week alone. This marks the sixth consecutive week of positive inflows, pushing the total to $10.5 billion since mid-April. Since their launch, these funds have collectively drawn $54.75 billion, cementing Bitcoin's position as a mainstream institutional asset.

BlackRock's IBIT led the charge with $2.57 billion in weekly inflows, underscoring Wall Street's growing appetite for cryptocurrency exposure. The ETFs now hold $152.4 billion worth of Bitcoin—equivalent to 6.5% of the cryptocurrency's total market capitalization. Daily flows remained robust throughout the week, peaking at $799.4 million on Wednesday.

The consistent demand reflects a broader market rotation into digital assets, with institutional investors increasingly using ETFs as their preferred on-ramp. This unprecedented accumulation period demonstrates Bitcoin's maturation from speculative asset to established portfolio holding.

Strategy Incorporated Launches Preferred Share IPO with 9% Initial Yield and Bitcoin Ambitions

Strategy Incorporated (MSTR) saw its stock rise 0.72% to close at $426.28 on July 21, with after-hours trading pushing it further to $427.90. The company announced an IPO for its new Variable Rate Series A Perpetual Stretch Preferred Stock, dubbed STRC Stock, offering an initial yield of 9%. Proceeds will be allocated for general corporate purposes, including Bitcoin acquisitions and working capital enhancements.

The offering, managed by leading financial institutions such as Morgan Stanley, Barclays, and TD Securities, underscores Strategy's aggressive push into blending structured financial products with digital asset strategies. The STRC Stock features flexible terms tied to market movements, combining crypto ambitions with yield-seeking investor appeal.

Sequans Communications S.A. (SQNS) Slides 6.85% After $150M Bitcoin Treasury Bet

Sequans Communications shares tumbled to $2.5150 despite an early surge above $3.60, as markets questioned the IoT chipmaker's aggressive pivot to Bitcoin treasury management. The Paris-based firm acquired 1,264 BTC at ~$118,659 per coin, bringing total holdings to 2,317 BTC worth $270 million.

Corporate crypto adoption faces renewed scrutiny as SQNS becomes the latest company to face investor skepticism over digital asset reserves. Trading volume spiked but failed to sustain momentum, reflecting the delicate balance between blockchain innovation and shareholder confidence in traditional markets.

Cryptocurrency Markets Brace for Volatility Ahead of Key Fed Decision

Cryptocurrencies opened the week on a positive note as markets positioned for next week's Federal Reserve interest rate decision. Bitcoin hovers near $117,880, testing a critical technical threshold that could trigger short-term volatility. A breakout from its current bullish flag pattern would confirm upward momentum, while failure risks a retest of $115,500 support.

Altcoins show relative strength against Bitcoin, suggesting potential rotation opportunities should BTC dominance weaken. However, the market remains vulnerable to hawkish Fed commentary or unexpected macroeconomic developments. Traders are closely monitoring the 2-hour chart for confirmation of either breakout or rejection at current levels.

Public Companies Now Hold Over $100 Billion in Bitcoin — 4% of Total Supply

Publicly traded companies have collectively amassed over 844,822 BTC, worth more than $100.5 billion, according to data from Bitcoin Magazine Pro. This milestone underscores a seismic shift in corporate treasury strategies, with institutional holdings now representing 4% of Bitcoin's total supply.

MicroStrategy leads the pack with 601,550 BTC ($71.5 billion), accounting for 2.86% of all Bitcoin. Marathon Digital, XXII, Riot Platforms, and Metaplanet round out the top five holders. Dubbed 'Asia's MicroStrategy,' Metaplanet has aggressively expanded its Bitcoin position, while Tesla, Coinbase, and Block maintain significant reserves as long-term balance sheet assets.

With adoption accelerating, analysts speculate whether public firms could collectively surpass 1 million BTC by 2025. The trend reflects Bitcoin's evolution from speculative asset to institutional hedge against fiat depreciation.

Bitcoin’s Plunge Sparks Concerns Amid Fed Chair Investigation

Bitcoin recently plummeted from $118,391 to $117,660, casting a shadow over the cryptocurrency market. This downturn coincides with geopolitical tensions as former President Donald Trump demands the resignation of Federal Reserve Chair Jerome Powell, citing dissatisfaction with Powell's refusal to cut interest rates.

Representative Anna Paulina Luna, a Republican from Florida, has called for a Department of Justice investigation into Powell, alleging he lied under oath regarding the cost overruns of the Federal Reserve’s Eccles Building renovation. The complaint letter highlights discrepancies in Powell’s testimony, with congressional investigators finding the project’s budget overruns were far from trivial.

The cryptocurrency market remains volatile as traders react to both macroeconomic pressures and political uncertainty. Bitcoin’s price action reflects broader concerns about regulatory scrutiny and institutional stability.

Trump Ignites Crypto Markets with Surprising Bitcoin Endorsement

Former US President Donald Trump sent shockwaves through cryptocurrency markets by sharing a 2017 Senate hearing video titled "the best Bitcoin explanation of all time" on his social media platform. The unexpected endorsement from a previously skeptical political figure triggered immediate market reactions, with Bitcoin's trading volume spiking and price volatility radiating across major altcoins.

Market analysts interpret this move as a potential pivot in Trump's stance toward digital assets, possibly signaling broader political calculations ahead of the 2024 election cycle. The video's resurgence has reignited debates about cryptocurrency regulation in Washington, with traders viewing the endorsement as a step toward institutional validation.

Financial strategists suggest the social media post may represent more than casual engagement—it could foreshadow policy shifts or campaign positioning. The market response underscores cryptocurrencies' growing sensitivity to political sentiment, particularly from influential figures capable of shaping regulatory narratives.

Bitcoin Price to Hit $250K This Year, Says Fundstrat’s Tom Lee

Tom Lee, co-founder of Fundstrat Global Advisors, has made a bold prediction on CNBC, forecasting Bitcoin could reach $250,000 by the end of 2025. With Bitcoin currently trading at $118,760.61—up 60% from $70,000—Lee argues the rally has substantial room to run. His thesis hinges on Bitcoin's growing recognition as a macro asset, akin to gold, with institutional adoption and political tailwinds fueling momentum.

Even at $250,000, Bitcoin would capture just 25% of gold's market value, suggesting significant upside potential. Lee's long-term outlook is even more ambitious: he posits Bitcoin could eventually surpass $1 million per coin if it solidifies its status as digital gold. "Digital gold means Bitcoin should be worth over a million," Lee stated, underscoring the asset's transformative potential in global finance.

Is BTC a good investment?

BTC presents a compelling risk/reward profile at current levels based on:

| Metric | Bullish Case | Risks |

|---|---|---|

| Technical | Price > 20MA, MACD recovery | Bollinger squeeze |

| Institutional | $10.5B ETF inflows | Fed policy shift |

| Sentiment | Trump endorsement, $250K forecasts | Regulatory scrutiny |

'DCA strategies may outperform given the Fed overhang,' advises Ava, noting BTC's 4.5x ROI potential per Fundstrat's targets requires surviving near-term volatility.